Why Financial Planning Matters at Every Age

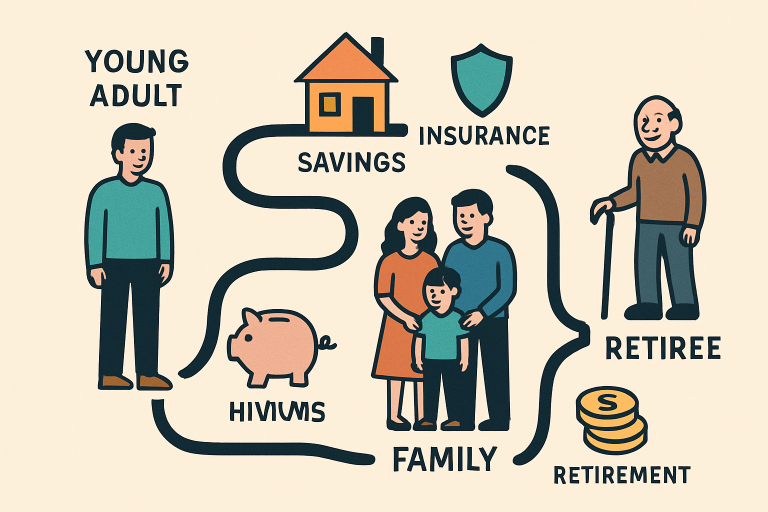

Financial planning is the cornerstone of personal stability and peace of mind, regardless of age or income bracket. Data from a recent CNBC report reveals that less than a third of Americans actively follow a comprehensive financial plan, leaving many susceptible to unforeseen expenses and economic stress. A plan offers a safety cushion and enables you to navigate life’s financial twists more confidently.

From early career professionals to those well into retirement, everyone benefits from establishing reliable money habits and building for the long term. Getting started often means seeking quality advice—consulting a trusted expert like Aaron Werner Financial Advisor, is an excellent first step. Whether crafting a plan from scratch or tightening up existing strategies, professional insight helps ensure your plan aligns with your goals and adapts to life’s changes.

Setting Clear Financial Goals

Effective planning starts by outlining specific, actionable objectives. These goals shouldn’t be vague aspirations but rather milestones with clear success criteria. Short-term goals might include building an emergency fund or paying down high-interest debt. At the same time, longer-term targets could encompass saving for retirement, buying a home, or funding children’s education. Break your planning into:

- Immediate: Reducing unnecessary expenses, starting a savings account.

- Mid-term: Setting aside money for a significant purchase or family trip.

- Long-term: Investing in retirement accounts, planning for generational wealth.

Assigning timelines and dollar figures to these goals makes progress measurable and motivates consistent action. Annual reviews are vital—realigning your actions with updated ambitions keeps plans fresh and attainable.

Tracking Expenses and Creating a Budget

Understanding where your money goes each month is essential to financial stability. Start by documenting every expense, no matter how small, for a clear view of spending patterns. Many people find that using personal finance software or simple spreadsheets significantly streamlines tracking and identifies problem areas.

- List every source of income.

- Track every outgoing expense for a month.

- Group expenses by category—essentials, discretionary, and savings or investments.

- Apply the 50/30/20 rule: 50% for needs, 30% for wants, 20% for future savings and debt repayment.

- Regularly assess and fine-tune your budget.

The Consumer Financial Protection Bureau’s budgeting resources offer a wealth of guidance and tools to ensure new budgeters start off on the right foot.

Emergency Funds and Insurance: Safety Nets You Need

Life is unpredictable, and hitting financial speed bumps is inevitable. Establishing an emergency fund is crucial—most experts suggest saving enough to cover three to six months’ expenses. This reserve acts as a buffer in case of job loss, medical emergencies, or urgent repairs, preventing setbacks from turning into crises.

Insurance is another essential pillar of any sound plan. Health, life, disability, and property policies protect you and your loved ones from life-altering financial shocks. These coverage needs evolve, so reassess policies as your family, career, or assets change and grow.

Long-Term Investments for the Future

With safety nets established, focus turns to growth. Investing for the long term can transform even modest monthly contributions into significant wealth, courtesy of compound interest and disciplined saving. Vehicles like 401(k)s, IRAs, and diverse investment portfolios are vital. According to the Federal Reserve, Americans who regularly invest in retirement accounts accrue much greater lifetime wealth than those who do not.

Diversification across stocks, bonds, and real estate mitigates risk while maximizing the growth potential. Rebalance your holdings periodically, especially as the market or risk tolerance shifts with age and life circumstances.

Reviewing and Adjusting Your Financial Plan

Financial planning isn’t a one-time event—it’s an ongoing process. Major life changes such as marriage, having a child, job transitions, or entering retirement require reexamining existing strategies. Experts recommend reviewing your entire plan annually to assess progress toward each goal, consider new opportunities, and correct course where necessary. Flexibility allows you to adapt seamlessly, ensuring your financial well-being is resilient.

Real-Life Examples of Financial Success

Real-world success stories highlight the importance of proactive planning. For instance, a college graduate who started investing a small portion of their first paycheck in a retirement plan watched their wealth multiply dramatically over twenty years, thanks to compound growth. Alternatively, a parent in mid-career leveraged their emergency fund to smoothly transition to a more fulfilling, yet initially uncertain, job. These examples underscore a vital truth: Financial security doesn’t require extraordinary luck—just time, discipline, and willingness to seek proven advice.

Conclusion

Creating a reliable financial plan is less about complexity and more about consistency, discipline, and adaptability. By setting clear goals, budgeting wisely, managing debt, and investing strategically, individuals can build a strong foundation for long-term security. Regularly reviewing and adjusting the plan ensures it remains aligned with changing life circumstances, whether starting a career, raising a family, or preparing for retirement. Seeking professional guidance can also provide clarity and confidence when navigating financial decisions. Ultimately, these simple yet effective steps empower individuals to take control of their future, protect their assets, and achieve peace of mind at every stage of life.